Some shortcuts simply aren’t worth the risk. Taking your applicants’ word for their monthly income is one of them.

Renters can list any income they want on their application, and failing to verify that income can drastically increase your risk of future payment problems.

At Innago, we know how much accurate information matters to our users and their rental businesses, and that’s the motivation behind our new income verification feature.

This feature allows potential tenants to quickly and easily verify their income by connecting to their bank account, payroll provider, or by uploading documents. Your applicants will pay a small $10 charge per application to have their income verified, letting you know which applications need further investigation.

Benefits of Income Verification

Performing income verification checks manually can cost you substantial time and energy. Automating the process makes tenant screening faster and more systematic.

Our new income verification feature can help you:

- Get real-time, accurate information about prospective applicants’ eligibility.

- Make more informed decisions about rental applicants.

- Reduce the risk of payment problems, from late and partial payments to evictions for nonpayment.

- Protect your business from pay stub fraud and other falsified documents.

- Verify the income of nontraditional workers, such as self-employed applicants.

- Decrease screening time, vacancy time, and tenant turnover.

How Does Income Verification Work?

What's happening behind the scenes when you choose to include Income Verification?

Innago's three-step process makes tenant income screening easy, seamless, and accurate by completing the following checks:

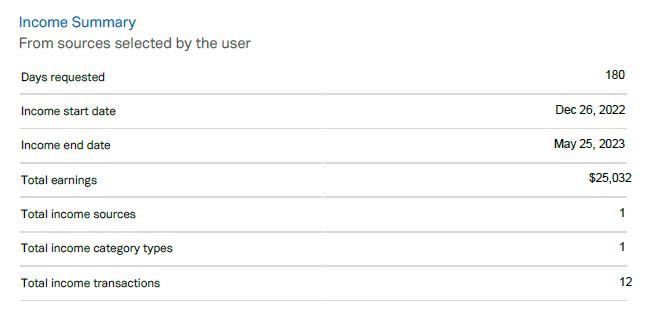

- Bank Verification: After applicants input their banking information, Innago's verification partners automatically analyze their statements to determine the applicant's average income.

- Payroll Verification: Applicants can simply connect their payroll provider and allow Innago to confirm their exact income amount alongside important documents like W2s and paystubs.

- Document Verification: If preferred or if for whatever reason the applicant can't complete the above options, they can always upload documents like paystubs or W2s. Innago's verification partners will then analyze each applicant's documents via machine learning (and, if required, human intervention) to ensure they are valid. This is particularly useful to help root out tricky applicants who could otherwise present you false documents when filling out their application.

How To Request Income Verification

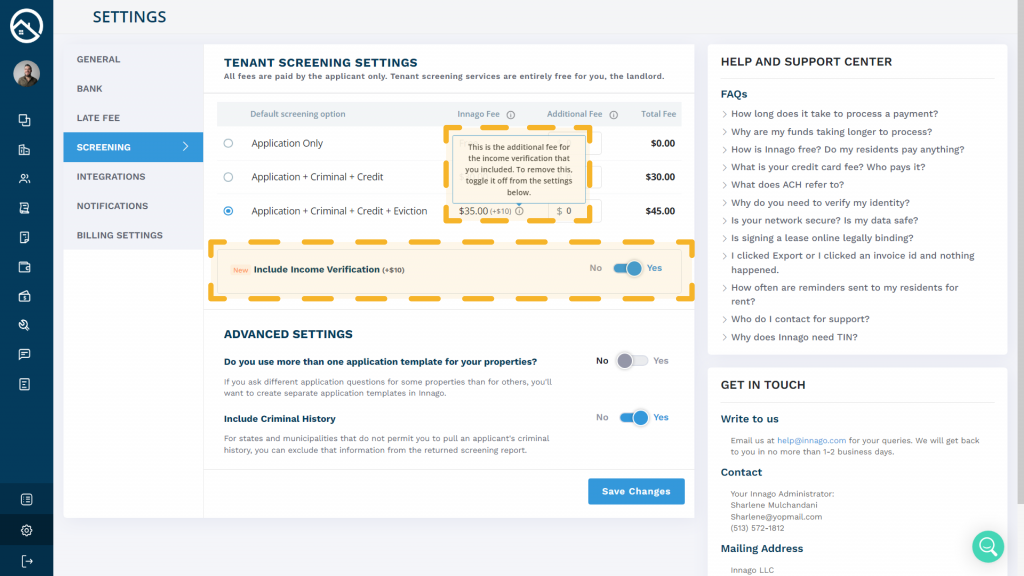

In order to enable Income Verification, you'll go to your Settings, then to the Screening tab. From here, you'll move the toggle for Include Income Verification to "Yes", then save your changes.

After making the update, you'll go to Applications from your main menu and click "Request Application". For more information on how to request an application, please click here.

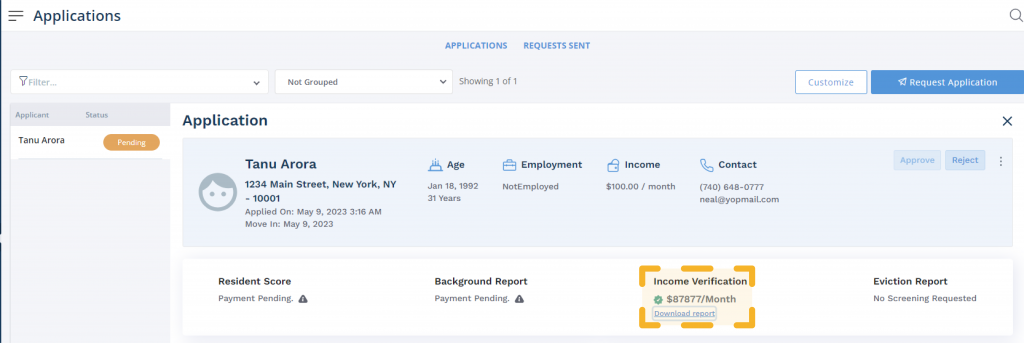

Once your applicant has completed their application and it is in a "For Review" status, you'll navigate to your Applications page from the main menu. You'll select the application you'd like to review from the available applications on this page, then click "Download Report".

Conclusion

Don’t be blindsided by rental fraudsters. Income verification can help you get fast, accurate information to motivate your rental decision-making and help you choose only the most qualified applicants for your properties.