Tenants Can Now Build Better Credit With Innago's Tenant Credit Reporting Feature

For the past three years, the average credit score needed to rent an apartment increased one point each year. The average credit score of renters in the U.S. was 638 in 2020 according to a study conducted by RentCafe. In the same study, they also found that in competitive markets – like San Francisco, Boston, New York, Seattle and Oakland – renters needed a credit score of 700 or above to be considered.

A different study published by Statista Research Department in 2019 found that 49 percent of renters were under 30 years old. These young adults, who make up a major percentage of renters, lack the experience and years required to build a great credit score. Since credit scores affect everything from your ability to rent, to getting a car loan, mortgage or credit card, it can be quite tough for younger renters.

Young renters need a better way to build their credit while managing their rent payments. Tenant credit reporting is one way to support people in this situation. We’ve had a lot of landlords and tenants reach out to us to request that we add tenant credit reporting to Innago. Well, we’re proud to announce that we have officially given the people what they asked for. Innago now offers tenants the ability to report their rental payments to build their credit score.

There are several advantages of this feature for both landlords and tenants, and we have listed some of these below:

For Landlords:

1. It’s Free for Everyone

We believe tenant’s should have a way to improve their credit history without paying for it, which is why we’re offering our credit reporting feature at absolutely no cost to landlords or tenants.

2. Reward Your Tenants

For tenants who make timely rent payments to you, this is a sweet reward for them. Even if they already have fantastic credit scores, they’ll appreciate the opportunity to bump their score up even further.

3. Transparency

It helps other landlords in the future by making it easier for them to see your tenants’ credit histories.

For Tenants:

1. Boost Your Credit Score

This is the best and most obvious benefit of this feature. On time payments over an extended period of time can have a significant impact on someone’s credit score. Studies have found that reporting rental payments can increase one’s credit score by an average of 29 points after just 2 months.

2. Long Term Renting Benefits

When deciding whether or not to rent to a tenant, most landlords run a full credit check. If a tenant is enrolled in Innago Credit Reporting, future landlords will be able to see proof of a long history of timely payments, making their application even more appealing.

3. Financial Opportunities

A better credit score also helps someone qualify for better credit cards, better interest rates on car loans and home mortgages, and more financial opportunities.

4. Free Add On

Good tenants are already making timely rental payments – why not gain some benefit from it? Innago’s Credit Reporting is an easy way for a tenant to build credit without taking on any debt.

How does this feature work?

Here’s how simple it is for a tenant to start reporting their rent payments:

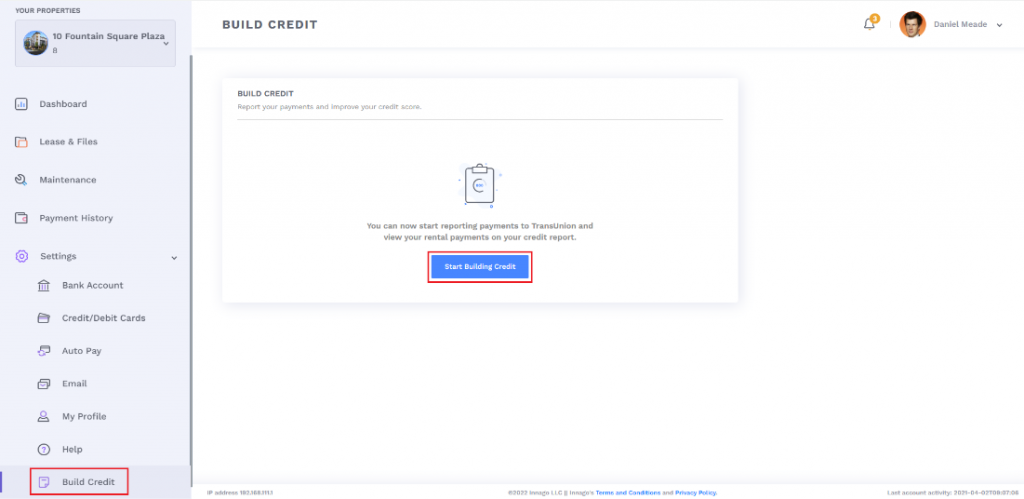

1) From the Innago menu on the left, click the ‘Settings’ tab and from the drop-down menu, select ‘Build Credit’.

2) On the center of this page, click ‘Start Building Credit’.

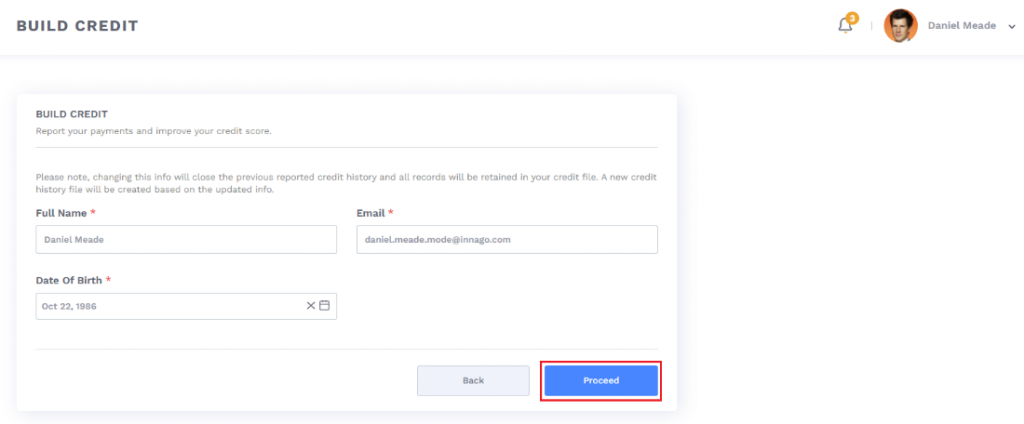

3) Here, they will need to enter their full name, email address and date of birth. Select ‘Proceed’ to continue.

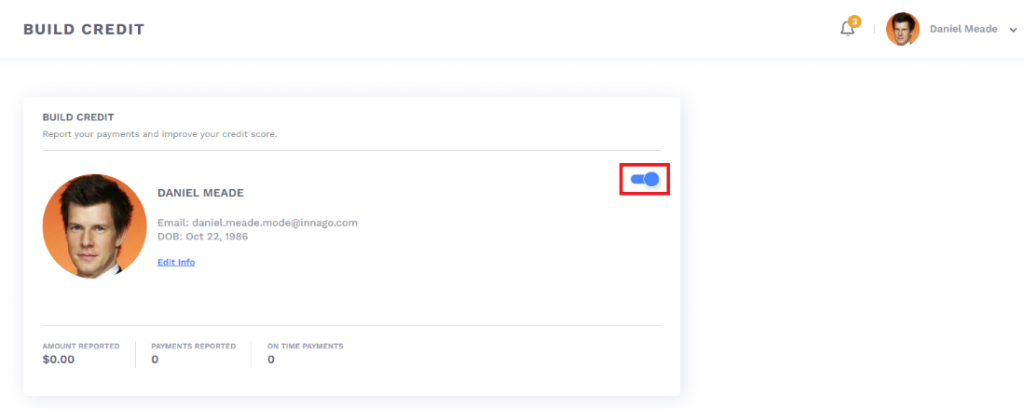

4) By default, the toggle will be turned ‘On’. If a tenant decides that they would like to un-enroll, then they would simply need to turn this toggle to ‘Off’.

Some Things To Keep In Mind:

- Currently, Innago only reports rental payments to TransUnion. We are exploring options to add Equifax and Experion credit reporting in the future.

- Innago begins reporting rent payments only after a tenant turns on the ‘Build Credit’ feature. This means that no past payments are reported to TransUnion.

- Only online payments made through Innago will be reported as positive payments. This means that if your tenant happens to pay you offline (cash, check, money order, etc.), these payments will not be reported even if you have recorded the rental invoice as paid on Innago.

- Offline payments will only serve to remove negative outcomes (if an invoice is reported late and you mark it paid, we will remove the record of the late payment from their credit report)

- All payment data is reported to TransUnion on the 15th of each month.

- Online payments collected for a security deposit, pet deposit, application fees, etc.

;will not be reported. - The credit bureaus consider any payment made within 30 days of the due date as “on time.” An invoice may be “Overdue” or may have been paid late in Innago, but it may still be recorded as a positive outcome on the tenant credit report. This is a rule of the credit bureaus that we do not control.

Conclusion

Landlords do not have to report their tenants' rent payments, but this is a good feature/add-on to offer to renters. At the end of the day, tenants have control over this feature and they can choose whether they would like to report their payments to credit bureaus or not.

However, if turned on, it has several benefits for both parties and does not require any additional effort by landlords.